Raport “Odpowiedzialne inwestycje. ESG na rynku nieruchomości” to kompendium wiedzy o zrównoważonym rozwoju na rynku nieruchomości i oczekiwaniach względem ESG,

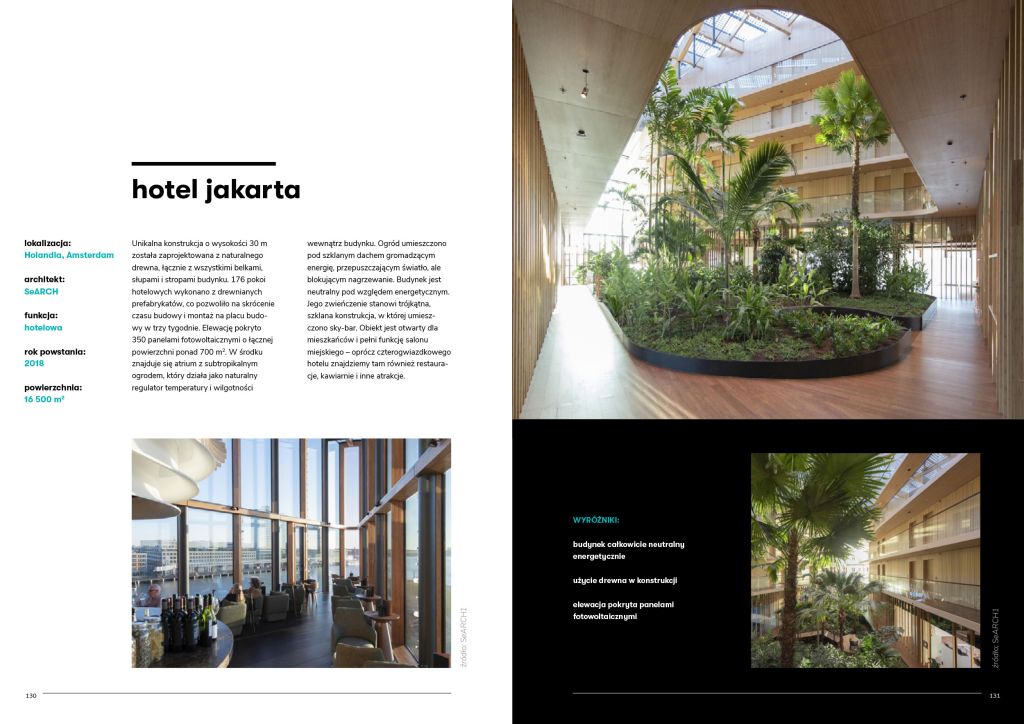

“Odpowiedzialne inwestycje. ESG na rynku nieruchomości” to raport opracowany przez ekspertów z zespołu ThinkCo expert team in cooperation with JW+APublication's strategic partners include Panattoni, Skanska and Torus. Publikacja tłumaczy co dla rynku nieruchomości oznaczają cele zrównoważonego rozwoju ONZ, wymagania raportowania niefinansowego ESG oraz dokumenty strategiczne Europejskiego Zielonego Ładu. Objaśnia też regulacje prawne, opisuje certyfikacje oraz podaje przykłady zielonych technologii i inspiracji ze świata

ESG

- dedicated ESG training

- assessment of company activities in accordance with EU legislation (ESG Compliance)

- preparation of ESG strategies

- legal advice on EU Taxonomy

- development of non-financial reports.

Analyses

- we develop personalized reports for internal client use

- market analyses

- real estate investment potential

- analyses of trends in construction and real estate

- strategic guidelines for product development

Investments

- audits of investment assumptions

- functional guidelines

- development of brand or investment strategies

- architectural and urban planning projects

- communication and placemaking strategy

Szkolenie: Taksonomia UE na rynku nieruchomości

Starting from 2020, taxonomic reports are becoming an important element of the investment strategy of enterprises from several sectors of the economy, including the real estate industry. Their importance will grow as more organizations are included in the reporting obligation - by 2026 there will be over 50,000 of them.

To help prepare for taxonomic reporting, the ThinkCo team has prepared a workshop specifically tailored to the needs of the real estate market.

Thanks to the workshop, you can:

- learn about the key elements of the EU taxonomy,

- understand the challenges and opportunities for business resulting from the reporting obligation,

- gain knowledge on the use of taxonomic reports in strategies,

- find out how your business can better fit in with the EU's environmental and climate goals.

Environmental costs

- Construction is the most material-consuming sector of the economy and consumes over 50% of the world's steel production.

- The sector is also responsible for 30% of global greenhouse gas emissions. Less than 1/3 of them are the result of the processes of material production, transport, construction and demolition. The remaining 2/3 is generated during the operational phase of buildings - almost 75% of buildings in Europe have low energy efficiency. At EU level, buildings are responsible for around 40% of energy consumption.

- The remaining 2/3 is generated during the operational phase of buildings - almost 75% of buildings in Europe have low energy efficiency. At EU level, buildings are responsible for around 40% of energy consumption.

- Long-term planning is essential to meet the commitments of the Paris Agreement. The primary goal is to achieve net zero emissions of the entire real estate market by 2050

ESG

- Almost 90% of the surveyed representatives of the real estate market believe that involvement in ESG is an important factor for the brand's success. The growing requirements for responsible business conduct are also driven by business, legislative and social pressure.

- According to a study by the Association of Investment Companies, 40% of investment advisers believe that ESG-focused projects lead to higher returns. A similar opinion was given by 56% of fund managers in the Research in Finance survey and 40% of investors in the Deutsche Bank Research survey.

- Building certification, depending on the system, ensures the use of environmentally and socially responsible solutions. In 2020, there were a total of 845 buildings certified in the BREEAM, LEED, DGNB, WELL and HQU systems in Poland.

The European Green Deal

- The key objectives of the European Green Deal include reducing greenhouse gas emissions to at least 55% below 1990 levels, reaching 40% for renewables in the EU's energy mix and increasing energy efficiency for final and primary energy consumption to 36-39%.

- The European Union will allocate 30% of its budget to financing the European Green Deal. More than € 500 billion will go to climate and environment, € 279 billion to program-related private and public investment, € 114 billion to national structural funds, € 100 billion to a fair transition mechanism and € 25 billion to transformation funds to help move away from coal.

- EU Sustainable Finance has two pillars - the EU Taxonomy and the draft CSRD directive. Until now, non-financial reporting had no imposed form and evaluation criteria. In the provisions of the EU Taxonomy, there is a set of technical criteria to assess which investments, products or services can be considered environmentally sustainable - and thus which of them is more secure in the long term.

- It is planned to create the so-called "brown taxonomy" that will focus on activities that negatively affect the achievement of the EU's climate goals. Work on the "social taxonomy" has also started, and ultimately all these documents will create a single taxonomy tool that will fully relate to ESG aspects.

Raport “Odpowiedzialne inwestycje. ESG na rynku nieruchomości” to kompendium wiedzy o zrównoważonym rozwoju na rynku nieruchomości i oczekiwaniach względem ESG

“Odpowiedzialne inwestycje. ESG na rynku nieruchomości” to raport opracowany przez ekspertów z zespołu ThinkCo expert team in cooperation with JW+APublication's strategic partners include Panattoni, Skanska and Torus. Publikacja tłumaczy co dla rynku nieruchomości oznaczają cele zrównoważonego rozwoju ONZ, wymagania raportowania niefinansowego ESG oraz dokumenty strategiczne Europejskiego Zielonego Ładu. Objaśnia też regulacje prawne, opisuje certyfikacje oraz podaje przykłady zielonych technologii i inspiracji ze świata

Sprawdź co możemy dla Ciebie zrobić!

At ThinkCo, we provide advice for modern investment projects. With our reports, support in environmental and social issues (ESG), and investment potential analyses, we help our clients achieve success in the real estate market while contributing to the sustainable development of the entire industry, without compromising on attractive investment returns.

ESG

- dedicated ESG training

- assessment of company activities in accordance with EU legislation (ESG Compliance)

- preparation of ESG strategies

- legal advice on EU Taxonomy

- development of non-financial reports.

Analyses

- we develop personalized reports for internal client use

- market analyses

- real estate investment potential

- analyses of trends in construction and real estate

- strategic guidelines for product development

Investments

- audits of investment assumptions

- functional guidelines

- development of brand or investment strategies

- architectural and urban planning projects

- communication and placemaking strategy

Szkolenie: Taksonomia UE na rynku nieruchomości

Starting from 2020, taxonomic reports are becoming an important element of the investment strategy of enterprises from several sectors of the economy, including the real estate industry. Their importance will grow as more organizations are included in the reporting obligation - by 2026 there will be over 50,000 of them.

To help prepare for taxonomic reporting, the ThinkCo team has prepared a workshop specifically tailored to the needs of the real estate market.

Thanks to the workshop, you can:

- learn about the key elements of the EU taxonomy,

- understand the challenges and opportunities for business resulting from the reporting obligation,

- gain knowledge on the use of taxonomic reports in strategies,

- find out how your business can better fit in with the EU's environmental and climate goals.

ThinkCo

We are the first advisory company in Poland specializing in new ideas for real estate. We combine the knowledge of researchers and architects with business world experience, creating innovative processes, products, and services for the real estate market.

We focus on interdisciplinarity. Our specialists come from various environments and represent different experiences, constantly expanding the range of our capabilities and knowledge. The role of ThinkCo is to use this knowledge as an opinion maker in the process of implementation of new solutions on the real estate market.